#business expansion india

Explore tagged Tumblr posts

Text

Expand Smart, Thrive Globally: Tailored Business Expansion Services

Elevate your business to new horizons with our comprehensive business expansion services. From market analysis to strategic planning, we provide customized solutions to ensure a seamless and successful expansion into new territories.

Catalyze your growth! Connect with us today for expert business expansion services and embark on a journey toward global success.

Visit- https://foxnangel.com/

#foxnangel#fdi in india#foreign direct investment#foreign investments#invest in india#investment opportunities#business expansion india#business expansion#business expansion services

0 notes

Text

[T]he Dutch Republic, like its successor the Kingdom of the Netherlands, [...] throughout the early modern period had an advanced maritime [trading, exports] and (financial) service [banking, insurance] sector. Moreover, Dutch involvement in Atlantic slavery stretched over two and a half centuries. [...] Carefully estimating the scope of all the activities involved in moving, processing and retailing the goods derived from the forced labour performed by the enslaved in the Atlantic world [...] [shows] more clearly in what ways the gains from slavery percolated through the Dutch economy. [...] [This web] connected them [...] to the enslaved in Suriname and other Dutch colonies, as well as in non-Dutch colonies such as Saint Domingue [Haiti], which was one of the main suppliers of slave-produced goods to the Dutch economy until the enslaved revolted in 1791 and brought an end to the trade. [...] A significant part of the eighteenth-century Dutch elite was actively engaged in financing, insuring, organising and enabling the slave system, and drew much wealth from it. [...] [A] staggering 19% (expressed in value) of the Dutch Republic's trade in 1770 consisted of Atlantic slave-produced goods such as sugar, coffee, or indigo [...].

---

One point that deserves considerable emphasis is that [this slave-based Dutch wealth] [...] did not just depend on the increasing output of the Dutch Atlantic slave colonies. By 1770, the Dutch imported over fl.8 million worth of sugar and coffee from French ports. [...] [T]hese [...] routes successfully linked the Dutch trade sector to the massive expansion of slavery in Saint Domingue [the French colony of Haiti], which continued until the early 1790s when the revolution of the enslaved on the French part of that island ended slavery.

Before that time, Dutch sugar mills processed tens of millions of pounds of sugar from the French Caribbean, which were then exported over the Rhine and through the Sound to the German and Eastern European ‘slavery hinterlands’.

---

Coffee and indigo flowed through the Dutch Republic via the same trans-imperial routes, while the Dutch also imported tobacco produced by slaves in the British colonies, [and] gold and tobacco produced [by slaves] in Brazil [...]. The value of all the different components of slave-based trade combined amounted to a sum of fl.57.3 million, more than 23% of all the Dutch trade in 1770. [...] However, trade statistics alone cannot answer the question about the weight of this sector within the economy. [...] 1770 was a peak year for the issuing of new plantation loans [...] [T]he main processing industry that was fully based on slave-produced goods was the Holland-based sugar industry [...]. It has been estimated that in 1770 Amsterdam alone housed 110 refineries, out of a total of 150 refineries in the province of Holland. These processed approximately 50 million pounds of raw sugar per year, employing over 4,000 workers. [...] [I]n the four decades from 1738 to 1779, the slave-based contribution to GDP alone grew by fl.20.5 million, thus contributing almost 40% of all growth generated in the economy of Holland in this period. [...]

---

These [slave-based Dutch commodity] chains ran from [the plantation itself, through maritime trade, through commodity processing sites like sugar refineries, through export of these goods] [...] and from there to European metropoles and hinterlands that in the eighteenth century became mass consumers of slave-produced goods such as sugar and coffee. These chains tied the Dutch economy to slave-based production in Suriname and other Dutch colonies, but also to the plantation complexes of other European powers, most crucially the French in Saint Domingue [Haiti], as the Dutch became major importers and processers of French coffee and sugar that they then redistributed to Northern and Central Europe. [...]

The explosive growth of production on slave plantations in the Dutch Guianas, combined with the international boom in coffee and sugar consumption, ensured that consistently high proportions (19% in 1770) of commodities entering and exiting Dutch harbors were produced on Atlantic slave plantations. [...] The Dutch economy profited from this Atlantic boom both as direct supplier of slave-produced goods [from slave plantations in the Dutch Guianas, from Dutch processing of sugar from slave plantations in French Haiti] and as intermediary [physically exporting sugar and coffee] between the Atlantic slave complexes of other European powers and the Northern and Central European hinterland.

---

Text above by: Pepijn Brandon and Ulbe Bosma. "Slavery and the Dutch economy, 1750-1800". Slavery & Abolition Volume 42, Issue 1. 2021. [Text within brackets added by me for clarity. Bold emphasis and some paragraph breaks/contractions added by me. Presented here for commentary, teaching, criticism purposes.]

#abolition#these authors lead by pointing out there is general lack of discussion on which metrics or data to use to demonstrate#extent of slaverys contribution to dutch metropolitan wealth when compared to extensive research#on how british slavery profits established infrastructure textiles banking and industrialisation at home domestically in england#so that rather than only considering direct blatant dutch slavery in guiana caribbean etc must also look at metropolitan business in europe#in this same issue another similar article looks at specifically dutch exporting of slave based coffee#and the previously unheralded importance of the dutch export businesses to establishing coffee mass consumption in europe#via shipment to germany#which ties the expansion of french haiti slavery to dutch businesses acting as intermediary by popularizing coffee in europe#which invokes the concept mentioned here as slavery hinterlands#and this just atlantic lets not forget dutch wealth from east india company and cinnamon and srilanka etc#and then in following decades the immense dutch wealth and power in java#tidalectics#caribbean#archipelagic thinking#carceral geography#ecologies#intimacies of four continents#indigenous#sacrifice zones#slavery hinterlands#european coffee#indigenous pedagogies#black methodologies

26 notes

·

View notes

Text

Apple To Invest More In India

As per undisclosed sources familiar with the matter, Apple Inc. is reportedly revamping the management of its international businesses to place a larger emphasis on India, reflecting the country's growing importance in the company's overall strategy. This move marks a significant milestone as India is set to become its own sales region at Apple for the first time, signaling the surging demand for Apple's products in the region. As a result, India is expected to gain greater prominence and visibility within the company.

The decision to focus on India could be a strategic move by Apple, given that India is one of the fastest-growing smartphone markets in the world. By prioritizing India, Apple may be seeking to gain a larger market share in the region, which could help the company offset slowing growth in other markets. The company's recent launch of an online store in India is further evidence of its commitment to expanding its presence in the country. Last quarter, despite a 5% dip in total sales, Apple achieved record revenue in India. The tech giant has set up an online store to cater to the region and plans to open its first retail stores there later this year. During the last earnings call, Apple CEO Tim Cook highlighted the company's significant emphasis on the Indian market and compared its current state to its early years in China. He mentioned how Apple is leveraging its learnings from China to scale in India. China is Apple's largest sales region after the Americas and Europe, generating around $75 billion in revenue per year. Apart from boosting Apple's sales, India is also becoming increasingly critical to the company's product development. Key suppliers are shifting to the region, and Apple is partnering with manufacturing giant Hon Hai Precision Industry Co. (also known as Foxconn) to establish new iPhone production facilities in India, according to Bloomberg News. Apple has been expanding its focus on the Indian market in recent years, and the company has been making efforts to improve its sales operations in the country. In 2020, Apple launched an online store in India, which allowed the company to sell its products directly to consumers in the country for the first time. This move was seen as a significant step for Apple, as India is one of the world's fastest-growing smartphone markets. If Apple is restructuring its international sales operations to put a more significant focus on India, it suggests that the company sees significant growth potential in the Indian market. Apple may be looking to increase its market share in India by focusing on pricing, localizing products and services, and building relationships with key partners in the country. It remains to be seen how Apple's restructuring will affect the company's operations in other regions. However, this move is undoubtedly a positive sign for India's tech industry, as it shows that major global players are taking note of the country's potential as a growth market.

Fox&Angel is an open strategy consulting ecosystem, put together by a top-line core team of industry experts, studded with illustrious success stories, learnings, and growth. Committed to curate bespoke business & strategy solutions for each of your challenges, we literally handpick consultants from across the globe and industries who fit the role best and help you on your path to success.

This post was originally published on: Foxnangel

#Apple India#Business expansion#business growth#FDI in India#Foreign Direct Investment#FoxNAngel#India market entry#Indian growing economy#Invest in India#Investment#strategy consulting

3 notes

·

View notes

Text

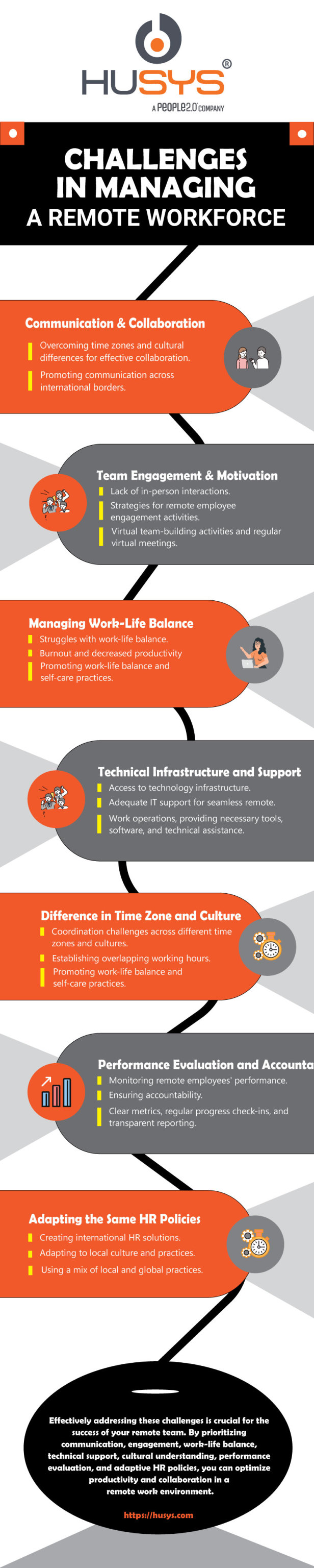

Managing a remote workforce brings unique challenges that can affect productivity and collaboration. To ensure your remote team's success, it's essential to tackle these challenges head-on. Check out my latest post to discover the common hurdles faced when managing a remote workforce and strategies for overcoming them. Let's thrive in the world of remote work! 💼🌍✨

#peo services in india#employer of record#peo services#payroll#payroll outsourcing#globalpayroll#business expansion#eor services india#remote work#remote workforce

2 notes

·

View notes

Text

The Hidden Costs of Running a Franchise in India: What No One Tells You

Franchising is often perceived as a low-risk, high-reward opportunity for aspiring entrepreneurs. With an established brand name, operational support, and a proven business model, owning a franchise in India seems like a lucrative investment. However, what many don’t realize are the hidden costs that come with running a franchise expenses that can impact profitability and long-term sustainability.

1. High Initial Investment and Franchise Fees

One of the biggest expenses in acquiring a franchise in India is the initial franchise fee. Many franchisors require a hefty payment upfront, which can range from a few lakhs to several crores, depending on the brand. While this covers training, branding, and initial support, it does not include operational costs, which can quickly add up.

2. Royalty and Marketing Fees

Franchise owners are typically required to pay ongoing royalty fees, which are a percentage of the revenue. This can range from 5% to 15% of monthly earnings. Additionally, franchisors often charge national or regional marketing fees to maintain brand awareness, which may not always translate into increased sales for individual franchise units.

3. Real Estate and Infrastructure Costs

Location is crucial to a franchise’s success. Securing a prime spot in a high-footfall area often means higher rental costs. Additionally, franchisors have strict requirements for store setup, interior design, and infrastructure, all of which contribute to significant expenses beyond the initial investment.

4. Employee Salaries and Training

While franchisors provide basic training, hiring and retaining skilled employees remains the franchisee’s responsibility. Salaries, incentives, and continuous training programs require consistent investment to ensure smooth operations and high customer satisfaction.

5. Inventory and Supply Chain Challenges

Many franchisors mandate that franchisees purchase inventory and supplies exclusively from their approved vendors. This often leads to higher procurement costs, as franchisees have limited bargaining power and cannot source from alternative suppliers.

6. Legal and Compliance Expenses

Running a franchise in India means adhering to multiple legal and regulatory requirements, including licensing, GST compliance, labor laws, and local municipal regulations. Hiring legal and accounting professionals to ensure compliance adds to the financial burden.

7. Unforeseen Expenses and Emergency Funds

Unexpected costs such as equipment breakdown, business downturns, and economic fluctuations can impact profitability. Franchise owners must set aside emergency funds to tackle these unpredictable situations.

Conclusion: Is a Franchise Worth It?

Owning a franchise in India comes with undeniable advantages, but entrepreneurs must be prepared for the hidden costs that can erode profits. Before making a decision, it is essential to conduct thorough research, consult experts, and assess long-term financial viability.

At Fox&Angel, we specialize in helping businesses navigate the complexities of franchising in India. Whether you are looking for the right franchise opportunity or need guidance on managing costs effectively, we can help. Contact us today to explore smart and profitable franchise strategies!

0 notes

Text

The Pros and Cons of Using a Personal Loan for Business Expenses

Starting or expanding a business requires significant financial investment, and for many entrepreneurs, securing funding can be a challenge. One potential financing option is a personal loan, which provides flexibility and quick access to funds. However, using a personal loan for business expenses comes with advantages and disadvantages. In this article, we will explore the pros and cons of using a personal loan for business purposes to help you determine if it is the right choice for your needs.

Understanding Personal Loans for Business Use

A personal loan is an unsecured loan provided by banks, credit unions, or online lenders. Unlike business loans, which are specifically designed for commercial use, personal loans are intended for individual borrowers. Despite this, many business owners use personal loans to fund their ventures, especially if they lack the necessary credit history or collateral to qualify for a business loan.

Before deciding to use a personal loan for business expenses, it is important to weigh the benefits and risks associated with this type of financing.

Pros of Using a Personal Loan for Business Expenses

1. Easy Application Process

One of the biggest advantages of a personal loan is its simple and quick application process. Unlike business loans, which often require extensive documentation, personal loans typically require only basic financial details, such as income, credit score, and employment verification. This streamlined process allows entrepreneurs to access funds quickly without the hassle of lengthy approvals.

2. No Collateral Required

Most personal loans are unsecured, meaning borrowers do not need to pledge collateral, such as property or business assets. This makes personal loans a viable option for new business owners who may not have valuable assets to use as security.

3. Flexible Usage

Lenders usually impose fewer restrictions on how personal loans can be used, giving business owners the freedom to allocate funds as needed. Whether you need money for inventory, marketing, or operational expenses, a personal loan offers flexibility.

4. Fixed Interest Rates and Predictable Payments

Many personal loans come with fixed interest rates, ensuring consistent monthly payments. This predictability makes budgeting easier and helps business owners manage cash flow effectively.

5. Can Help Build Credit

If you make timely repayments, a personal loan can improve your credit score. This can be beneficial in the long run, making it easier to qualify for future financing options, including business loans with better terms.

Cons of Using a Personal Loan for Business Expenses

1. Higher Interest Rates

Compared to traditional business loans, personal loans often come with higher interest rates, especially for borrowers with less-than-perfect credit. Over time, higher interest costs can put a strain on your business finances.

2. Lower Loan Limits

Personal loans typically have lower borrowing limits compared to business loans. If your business requires substantial capital, a personal loan may not provide sufficient funding.

3. Personal Liability

When you take out a personal loan for business purposes, you are personally responsible for repaying the debt. If your business fails or encounters financial difficulties, you will still need to make repayments, which could impact your personal financial stability.

4. Potential Credit Score Impact

Using a personal loan for business can impact your personal credit score. If you struggle to make timely payments, your credit score could decline, making it harder to qualify for future loans.

5. Limited Tax Benefits

Business loans often come with tax-deductible interest expenses. However, with personal loans, interest payments are generally not tax-deductible, which can increase the overall cost of borrowing.

When to Consider a Personal Loan for Business

While personal loans may not be the best option for every business, they can be beneficial in certain situations, including:

Startups and new businesses: If you do not qualify for a business loan due to a lack of business credit history, a personal loan may provide the initial capital needed.

Short-term funding needs: If you need a small amount of money for immediate expenses, a personal loan can be a quick solution.

Entrepreneurs with strong personal credit: If you have excellent credit, you may qualify for a personal loan with favorable terms, making it a viable funding option.

Alternatives to Personal Loans for Business Expenses

If you are unsure whether a personal loan is the right choice, consider these alternative financing options:

1. Business Loans

Business loans are specifically designed for entrepreneurs and typically offer higher loan limits, lower interest rates, and tax-deductible interest payments. However, they may require collateral and a strong business credit history.

2. Business Credit Cards

Business credit cards provide a revolving line of credit that can be useful for managing short-term expenses. Some cards offer rewards and cashback benefits, making them a flexible funding option.

3. SBA Loans

Small Business Administration (SBA) loans offer government-backed financing with competitive interest rates and longer repayment terms. They are ideal for businesses looking for substantial funding with favorable terms.

4. Crowdfunding and Investors

If you prefer not to take on debt, consider crowdfunding or seeking investors. Platforms like Kickstarter and GoFundMe allow entrepreneurs to raise funds from supporters, while angel investors and venture capitalists provide funding in exchange for equity.

Final Thoughts

Using a personal loan for business expenses has its pros and cons. While it offers fast and flexible funding, it also comes with risks, such as higher interest rates and personal liability. Before applying for a personal loan, carefully evaluate your business needs, financial situation, and repayment capacity.

If you decide to use a personal loan, ensure you borrow responsibly and have a clear repayment plan in place. Alternatively, explore other financing options, such as business loans or SBA loans, to find the best funding solution for your business.

For more insights on personal loans and financial strategies, visit Fincrif today!

#finance#fincrif#bank#personal loans#loan apps#nbfc personal loan#loan services#personal loan online#personal loan#personal laon#Personal loan for business#Business financing options#Startup funding with personal loan#Small business loan alternative#Pros and cons of personal loan#Business expansion funding#Personal loan vs business loan#Low-interest personal loan#Unsecured loan for business#Self-employed financing#Personal loan repayment terms#Using personal loan wisely#Business loan eligibility#Debt management for entrepreneurs#Best personal loans for business#fincrif india#best bank for personal loan#best personal loan rates

0 notes

Text

International Business Management Negotiation Strategies

#International Business Management#Global Business Negotiations#Business Negotiation Skills#Business Management in India#International Market Expansion#International Business Education#Colleges for International Business#PGDM in Internatioanl Business

1 note

·

View note

Text

Linde India Signs New Salary Agreement with Workers Union

Employees to receive Rs 5,800 monthly gross salary hike and enhanced benefits Linde India and Indian Oxygen Workers Union reach a new 3.5-year salary agreement, boosting employee compensation and benefits. JAMSHEDPUR – Linde India and the Indian Oxygen Workers Union have signed a new salary agreement, significantly increasing employee compensation and benefits over a 3.5-year period. The…

#बिजनेस#business#corporate employee welfare#employee compensation increase#Indian Oxygen Workers Union#industrial sector salary hike#Jamshedpur industrial relations#Jamshedpur labor agreements#Linde India salary agreement#Linde India workforce investment#mediclaim coverage expansion#retirement benefits enhancement

0 notes

Text

#Pharma Franchise#Franchise Business#Pharma Industry#Business Opportunity#Pharma Franchise Tips#Franchise Advice#Pharma Franchise India#Franchise Growth#Pharma Franchise Guide#Business Expansion#Pharma Franchise Model#Franchise Success#Pharma Business#Franchise Investment#Pharma Franchise Opportunities

0 notes

Text

#foxnangel#india market entry#business expansion#foreign investments#investment opportunities#foreign direct investment#invest in india#fdi in india#business consulting#business expansion india#business expansion services

0 notes

Text

#tax#payroll#accounting#business#finance#Global Payroll#Payroll#HR#Global Expansion#EOR#India Payroll#UK Payroll#Outsourcing#company registration#eor services#poe hr#poe employer#poe employment#payroll poe#global peo#eor providers#payroll processing#payroll services#payroll software#online payroll#outsourced payroll#tax filing for payroll#payroll tax compliance#direct deposit#pay stubs

0 notes

Text

Business Opportunities in India: Where to Invest and Why

India, the world's most populous democracy and one of the fastest-growing major economies, presents a vast array of business opportunities for both domestic and international investors. With a burgeoning middle class, rapid urbanization, and a young, tech-savvy population, the country has emerged as a fertile ground for a diverse range of industries.

This blog delves into the sectors offering lucrative investment opportunities in India and explores why these areas are poised for substantial growth.

1. Technology and Startups

Why Invest?

India's technology sector is one of the most dynamic in the world, driven by a robust IT ecosystem, a large pool of skilled talent, and an increasing demand for digital solutions. The country is home to a vibrant startup ecosystem, particularly in cities like Bengaluru, Hyderabad, and Pune, where tech innovation is thriving.

Key Areas to Watch:

- Fintech: With India's large unbanked population and the government's push for digital transactions through initiatives like Digital India, fintech startups are experiencing rapid growth. Innovations in payment solutions, lending, and insurance are gaining traction.

- EdTech: The pandemic accelerated the adoption of online education, and this trend is expected to continue. Platforms offering skill development, remote learning, and educational content are seeing high demand.

- HealthTech: The healthcare sector is ripe for disruption with the integration of technology. Telemedicine, health management apps, and AI-driven diagnostic tools are areas with significant investment potential.

2. Renewable Energy

Why Invest?

India's commitment to reducing its carbon footprint and transitioning to renewable energy sources presents substantial opportunities for investment. The country has set ambitious targets to increase its renewable energy capacity and reduce reliance on fossil fuels.

Key Areas to Watch:

- Solar Energy: India has abundant sunshine, making it an ideal location for solar power projects. The government’s incentives and subsidies for solar installations add to the attractiveness of this sector.

- Wind Energy: With vast coastal areas and strong wind patterns, wind energy is another promising sector. Investments in offshore and onshore wind farms are gaining momentum.

- Energy Storage: As renewable energy sources are intermittent, advancements in energy storage technologies such as batteries are crucial. This sector is vital for ensuring a reliable energy supply.

3. E-Commerce and Retail

Why Invest?

The rapid growth of internet penetration and smartphone usage has fueled the expansion of e-commerce in India. The retail sector, both online and offline, is undergoing a transformation driven by changing consumer preferences and the rise of a tech-savvy middle class.

Key Areas to Watch:

- Online Retail: The convenience of online shopping and the increasing number of internet users make this sector highly lucrative. Niche markets, such as luxury goods, organic products, and regional specialties, are particularly promising.

- Omni-Channel Retail: Combining online and offline shopping experiences is becoming popular. Investments in technologies that enhance the customer experience across multiple channels are likely to see growth.

- Direct-to-Consumer (D2C): Brands that bypass traditional retail channels to sell directly to consumers are gaining traction. This model allows for better customer engagement and higher margins.

4. Infrastructure and Real Estate

Why Invest?

India's infrastructure development is essential for sustaining economic growth and urbanization. The government’s focus on improving infrastructure, including transportation, housing, and smart cities, creates numerous investment opportunities.

Key Areas to Watch:

- Smart Cities: The Smart Cities Mission aims to create sustainable and citizen-friendly urban spaces. Investments in smart infrastructure, including transportation, utilities, and urban planning, are expected to be lucrative.

- Affordable Housing: With a growing population and urban migration, there is a significant demand for affordable housing. Government schemes and subsidies further enhance the attractiveness of this sector.

- Logistics and Warehousing: As e-commerce grows, so does the need for efficient logistics and warehousing solutions. Investments in supply chain infrastructure and technology can yield substantial returns.

5. Healthcare and Pharmaceuticals

Why Invest?

India's healthcare sector is undergoing rapid expansion due to increasing health awareness, a growing population, and advancements in medical technology. The pharmaceutical industry, a global leader in generic drugs, also offers considerable investment opportunities.

Key Areas to Watch:

- Healthcare Services: Investments in hospitals, diagnostic centers, and specialty clinics are growing. There is a rising demand for quality healthcare services and innovative medical solutions.

- Pharmaceutical R&D: India is a major player in the global pharmaceutical industry, particularly in generic drugs. Investment in research and development of new drugs and treatments can be highly profitable.

- Medical Devices: The increasing prevalence of chronic diseases and technological advancements drive demand for medical devices and equipment. This sector is poised for growth as India’s healthcare infrastructure expands.

6. Agriculture and Agribusiness

Why Invest?

Agriculture remains a cornerstone of the Indian economy, employing a significant portion of the population. With modernization and technological advancements, the agribusiness sector offers numerous investment opportunities.

Key Areas to Watch:

- AgriTech: Technology-driven solutions for improving agricultural productivity, such as precision farming, crop monitoring, and supply chain management, are gaining traction.

- Food Processing: As incomes rise, so does the demand for processed and packaged foods. Investments in food processing units, cold storage, and supply chain infrastructure can be highly profitable.

- Sustainable Farming: There is a growing emphasis on sustainable and organic farming practices. Investing in technologies and practices that promote environmental sustainability can capture the increasing consumer demand for organic produce.

7. Tourism and Hospitality

Why Invest?

India’s rich cultural heritage, diverse landscapes, and historical landmarks make it a prime destination for tourism. The sector, which was hit hard by the pandemic, is on a recovery path and presents significant investment opportunities.

Key Areas to Watch:

- Luxury and Experiential Tourism: There is a rising demand for unique travel experiences and luxury accommodations. Investments in high-end resorts, experiential travel, and niche tourism segments are promising.

- Medical and Wellness Tourism: India is known for its traditional wellness practices like Ayurveda and yoga. The country’s healthcare system also attracts international patients seeking affordable medical treatments.

- Infrastructure Development: Enhancing tourism infrastructure, including transport, accommodations, and attractions, is crucial for supporting the sector’s growth.

India’s diverse and rapidly evolving market offers a wealth of business investment opportunities in india across various sectors. The country’s young population, growing middle class, and government initiatives to foster economic growth create a favorable environment for investors. Whether you are interested in technology, renewable energy, e-commerce, infrastructure, healthcare, agriculture, or tourism, India presents a range of options for those looking to capitalize on its dynamic economic landscape. By carefully analyzing market trends, understanding regulatory frameworks, and leveraging local expertise, investors can unlock significant growth potential in this vibrant and promising market.

Investing in India requires a strategic approach, but the potential rewards are substantial for those who navigate its complexities and seize the opportunities that align with their business goals and interests.

Fox&Angel your leading Global Expansion Partner specializing in foreign direct investment (FDI) in India, offering invaluable expertise for businesses aiming to enter or expand in this dynamic market. With a deep understanding of India's economic landscape and regulatory environment, Fox&Angel provides comprehensive support to help navigate the complexities of investing in India. Whether you're looking to expand your existing operations, enter new markets, or make a direct investment, Fox&Angel’s seasoned team assists in identifying the most promising opportunities, ensuring compliance, and optimizing your investment strategy. By leveraging their extensive local knowledge and resources, you can confidently make informed decisions and achieve your business goals in India’s rapidly evolving economy.

This post was originally published on: Foxnangel

#business opportunity#where to invest money#Investing in India#renewable energy#global expansion#fdi investment in india#fdi in india#foxnangel#franchise in india

0 notes

Text

Raspberry Pi Pico Expansion Shield

Unlock the full potential of your Raspberry Pi Pico with the Expansion Shield. This versatile accessory offers a seamless way to connect various sensors, displays, and peripherals to your Pico board, making it a powerful tool for your projects.

#Raspberry Pi Pico Expansion Shield#electronics#best electronic components online buy india#electronic components#best electronic components online store#buy electronic components online store in india#business#electronic components online store#top online electronic components shop#arduino#home & lifestyle

0 notes

Text

Why Outsourcing to India Is No Longer Just About Cost – It’s About Expertise

For decades, businesses worldwide have looked at outsourcing in India as a cost-cutting strategy. While India remains an attractive destination for cost efficiency, the landscape has evolved dramatically. Today, outsourcing to India is not just about reducing expenses; it is about tapping into an unparalleled pool of expertise, innovation, and technological advancement. Leading firms like Fox&Angel are driving this transformation by helping businesses leverage India's exceptional talent and domain-specific proficiency.

The Shift from Cost to Competence

Traditionally, outsourcing was synonymous with offshoring low-cost labor. However, India's evolution into a global knowledge hub has made it the preferred destination for companies seeking high-quality services across industries like IT, healthcare, finance, and engineering. Outsourcing in India is now driven by:

Highly Skilled Workforce: India boasts a vast talent pool of engineers, software developers, data scientists, and business analysts who bring deep domain expertise to the table.

Technological Innovation: Indian outsourcing firms invest heavily in AI, automation, and cloud computing, offering cutting-edge solutions to businesses worldwide.

Process Excellence & Quality Standards: Companies like Fox&Angel ensure global compliance, robust security, and industry best practices, making India a hub for high-quality service delivery.

Scalability & Flexibility: Businesses of all sizes, from startups to global enterprises, benefit from the scalability and adaptability that Indian service providers offer.

Expertise Across Multiple Domains

IT & Software Development

India remains a powerhouse in IT outsourcing, with companies offering expertise in areas such as cybersecurity, big data analytics, AI, blockchain, and cloud solutions.

Business Process Outsourcing (BPO)

The BPO sector in India is no longer about customer support alone. It now includes high-value services like legal process outsourcing (LPO), knowledge process outsourcing (KPO), and financial research.

Healthcare & Pharma Outsourcing

India is emerging as a leader in healthcare outsourcing, offering medical research, telemedicine support, and pharmaceutical R&D solutions.

Financial & Legal Services

Outsourcing financial and legal functions to India allows businesses to access world-class compliance expertise, risk management, and forensic accounting at competitive rates.

Why Fox&Angel Is Your Ideal Outsourcing Partner

At Fox&Angel, we understand that modern businesses demand more than just cost savings. We connect enterprises with industry-leading talent, ensuring operational excellence, security, and a competitive edge in their respective domains. With our strategic approach to outsourcing in India, we empower businesses to innovate, scale, and thrive in an increasingly competitive global market.

Conclusion: The Future of Outsourcing Is Expertise-Driven

As businesses evolve, so does the outsourcing landscape. Companies no longer seek just affordability; they demand expertise, quality, and innovation. Outsourcing in India has transitioned from being a mere cost-effective strategy to a powerhouse of skilled professionals and technological advancements. If you are looking for a strategic partner to navigate this new era of outsourcing, Fox&Angel is here to help.

Contact us today to explore how we can elevate your business through expert-driven outsourcing solutions.

0 notes

Text

Significance Of Pay Per Click To Build Your Business

the significance of Pay Per Click(PPC) advertising in building a business cannot be overstated. It provides businesses with instant visibility, flexibility, and scalability, allowing them to reach their target audience directly and generate quality leads. By leveraging the power of PPC, businesses can effectively build their online presence, increase brand awareness, and drive targeted traffic to their websites, ultimately leading to business growth and success.

#PPC Boost#Business Growth#Digital Advertising#Online Marketing#PPC Strategy#Targeted Ads#Increase Visibility#Drive Traffic#Conversion Rate#ROI#PPC Management#Ad Campaigns#Business Success#PPC Advertising#Online Visibility#PPC Expert#Marketing Strategy#PPC Success#Business Expansion#PPC Results#Levycon India#Pay Per Click Advertising#Digital Marketing#Online Advertising#Increase Sales#Targeted Traffic#Brand Awareness#Lead Generation#Cost Effective Advertising#PPC Tips

0 notes

Text

Reliance Industries: Pioneering Innovation, Driving Growth, Shaping the Future

Reliance Industries Limited (RIL) stands as a beacon of industrial might and innovation, not just within the confines of India but on the global stage. Founded by Dhirubhai Ambani in the 1960s, it has metamorphosed from a modest textile manufacturer into a behemoth straddling various sectors, including petrochemicals, refining, oil and gas exploration, retail, telecommunications, and digital…

View On WordPress

#Call to Action#Challenges#Corporate Social Responsibility#Corporate sustainability in India#Digital transformation in Indian retail sector#Future Outlook#Global Market#Global market expansion strategies#Indian conglomerates#Indian Economy#Innovation#Mukesh Ambani&039;s leadership#Opportunities#Petrochemical industry innovations#Regulatory challenges in Indian business#Reliance Industries#Reliance Industries growth trajectory#Reliance&039;s impact on Indian digital revolution#Reliance&039;s role in India&039;s energy sector#Sustainability#Technology

1 note

·

View note